In the fast-paced world of cryptocurrency, the decision of whether to repair or replace your Bitcoin miner is far from trivial. With the market for Bitcoin continuously fluctuating and mining technology evolving at an astounding rate, miners are often faced with a critical question: is it more cost-effective to repair my existing mining rig or invest in a new one? This article delves into the factors influencing this decision, weighing costs, efficiency, and the role of innovation.

To fully grasp this dilemma, one must first consider the operational costs associated with cryptocurrency mining. Electricity is the lifeblood of this endeavor, accounting for a significant percentage of overall expenses. As mining rigs like the Antminer S19 Pro or the Innosilicon T3+ become more power-efficient, assessing the electricity consumption of older models versus new ones can yield valuable insights. Higher efficiency means lower costs, and in a field where margins can be razor-thin, every watt saved is crucial.

Moreover, performance metrics must be evaluated. The hash rate of a miner fundamentally dictates how many computational problems it can solve in a given timeframe. As technology advances, newer miners often come equipped with superior hash rates, which translates to greater potential rewards in Bitcoin. So, if your current miner is lagging behind in terms of processing power, switching to a newer model may yield a higher return on investment (ROI) in the long run.

However, while the lure of cutting-edge technology is compelling, many miners still find value in repairing existing rigs. Costs associated with repairs—like replacement of fans, power supplies, or firmware updates—can be significantly lower than a new machine’s price tag. If the miner has been yielding consistent results and requires minimal maintenance, repair might be the smarter choice. This evaluation should include considerations around warranty and long-term reliability.

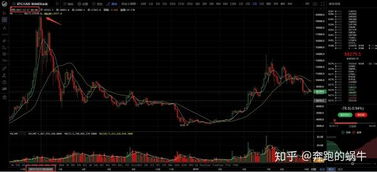

Another crucial factor influencing this decision is the impact of cryptocurrency market trends. Bitcoin, Ethereum, and Dogecoin each exhibit unique price movements, and these fluctuations can sway the economic justification for upgrading or maintaining mining hardware. A rise in Bitcoin prices could incentivize investment in more advanced machinery, while a downturn might lean towards frugality and repair. Ultimately, keeping an eye on market cycles helps miners make informed decisions.

The landscape of cryptocurrency exchanges further complicates the situation. The choice of where to sell mined coins can directly affect profitability. Some exchanges offer lower fees, which can enhance returns. Miners might contemplate whether to reinvest proceeds into new hardware or to buffer against market volatility by retaining mined cryptocurrencies. Such strategies require careful planning and a thorough understanding of personal and corporate financial goals.

When contemplating whether to repair or replace, it’s also wise to consider future-proofing. Choosing a machine with scalability options or one that’s compatible with the forthcoming advancements in blockchain technology could be beneficial. This foresight allows for smoother transitions as the mining landscape evolves, especially with other currencies like Ethereum transitioning to Proof of Stake, which dramatically changes the mining paradigm.

Furthermore, miners have the option of hosting their rigs in a dedicated mining farm. Here, professionals manage the technical aspects, optimize machine performance, and mitigate the risks associated with running operations independently. The cost analysis shifts once you include hosting fees, but for many, the ability to delegate technical headaches can lead to higher overall efficiency and profits.

In conclusion, the decision of whether to repair or replace a Bitcoin miner doesn’t come with a one-size-fits-all answer. Each miner, be it a small home operator or a large-scale enterprise, must weigh several factors—including operating costs, performance, market trends, and future scalability. By carefully evaluating these elements, miners can arrive at the best course of action, enhancing their chances for success in the competitive cryptocurrency mining realm.

This article offers a thorough examination of the costs associated with repairing versus replacing Bitcoin miners. It intelligently outlines economic implications, miner efficiency, and technological advancements, providing a nuanced perspective that helps miners make informed decisions amid fluctuating market conditions. A must-read for both novices and seasoned miners.