Mining deposits have emerged as a pivotal topic in the cryptocurrency world, drawing attention from enthusiasts and investors alike. As digital currencies like Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOG) continue to rise in popularity, understanding the mining process and its associated financial intricacies is crucial. For those involved in mining or looking to venture into this sector, getting familiar with deposits and refunds can mean the difference between success and loss in an ever-fluctuating market.

At its core, mining is the process of verifying transactions on a blockchain, where miners utilize powerful hardware known as mining rigs. These miners compete to solve complex mathematical problems, validating blocks of transactions. In most instances, miners are required to put down a deposit—essentially a commitment to ensure they participate in the network responsibly. This deposit is typically refundable upon completing specific criteria or when ceasing operations. However, navigating the conditions surrounding these refunds can be labyrinthine.

The conditions that govern mining deposit refunds largely differ across mining farms and platforms. Some exchanges might specify timelines for refunds, while others may impose penalties based on inactivity or premature withdrawal. Understanding these nuances is essential for miners to safeguard their investments. In a world where time is money, delays can equate to significant losses, especially if market conditions shift dramatically during waiting periods.

Let’s dive deeper into the refund process. Upon the completion of a miner’s contractual obligations, the protocol for refunding deposits should ideally be straightforward. Miners should verify that they understand all terms outlined in any contracts they sign, including specific details like potential fees for disconnecting equipment early or penalties for violating operational agreements. Transparency is key, as discrepancies can lead to frustrating disputes, drawing energy and resources away from actual mining operations.

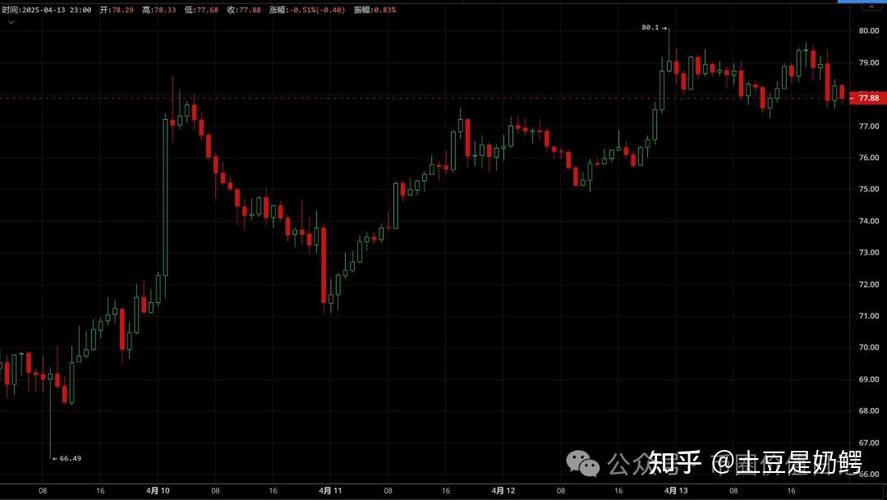

Moreover, the fluctuations in cryptocurrency values can also affect the refund amounts. For instance, if a miner deposits 0.1 BTC as collateral and Bitcoin’s value spikes after the deposit, the miner might wish to reevaluate the circumstances of withdrawing their deposit. Understanding the market dynamics around Bitcoin, Ethereum, and other cryptocurrencies allows miners to make informed decisions that align strategically with market trends.

<pHosting mining rigs has become a viable alternative for many miners. Rather than investing heavily in physical infrastructure, miners can choose to host their equipment at specialized facilities. This shift with hosted mining operations may present different deposit structures and refund policies. Understanding these policies is vital as they can significantly vary between host providers, often influenced by the quality of service, energy costs, and facility security.

For miners considering hosting services, it’s critical to select reputable providers who prioritize transparency and support. Good hosts will not only clarify deposit procedures but also ensure contracts are clear regarding terms of service and refund policies. This diligence helps avert the surprises that can tarnish the mining experience. Whether hosting a single mining rig or a burgeoning mining farm, support and clarity are essential prerequisites for minimizing risks.

The community aspect of mining also plays a role in deposit refunds. Engaging with other miners through forums, social media, or local meetups can provide insights and shared experiences regarding various platforms. By pooling knowledge about deposit refund procedures, miners can navigate their chosen platforms more judiciously. It’s an aspect of the cryptocurrency ecosystem that underscores the importance of network knowledge as miners can voice concerns and learn best practices together.

<pIn conclusion, as cryptocurrencies like Bitcoin, Ethereum, and Dogecoin evolve, miners must remain informed and proactive in understanding the financial mechanics of their operations. From deposit structures to refund policies, a keen awareness of these factors will not only influence their mining success but also foster a safer and more profitable environment within the digital currency landscape. The diligent miner is one who charts their course with careful consideration, ensuring their deposit remains a tool for growth rather than an unforeseen burden.

A vital guide unraveling mining deposit refunds. Navigating complexities made simple! Essential for miners seeking clarity and maximizing returns. Expert advice, demystified process.